REVERSE CHARGE MECHANISM IN GST

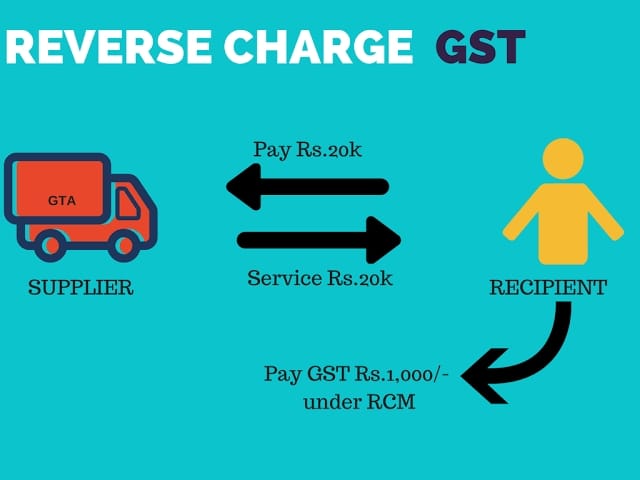

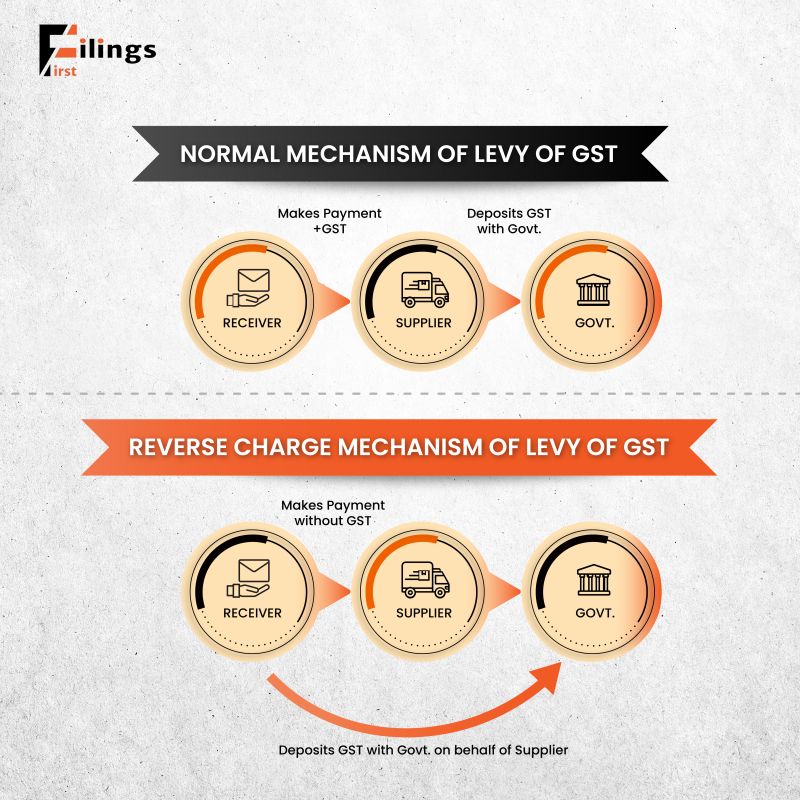

A technique known as “reverse charge mechanism” places the burden of Goods and Services Tax (GST) on the recipient of the goods or services rather than the supplier.

REVERSE CHARGE MECHANISM IN GST?

The tax on supply is normally paid by the provider of the products or services. Reverse charge reverses chargeability, meaning that the person who received the goods or services is now responsible for paying the tax.

By moving the onus of GST payments to the recipient, the aim is to tax services imported (as the supplier is based outside India), expand the scope of tax levies on certain unorganised industries, and exclude some types of suppliers.

WHEN IS REVERSE CHARGE MECHANISM APPLICABLE?

The reverse charge possibilities for intrastate transactions are governed by Sections 9(3), 9(4), and 9(5) of the Central GST Act and the State GST Acts. The Integrated GST Act’s sections 5(3), 5(4), and 5(5) also control the circumstances in which reverse charges are applied to interstate transactions.

Let’s talk about these circumstances in more detail:

A.Provision of certain products and services as directed by the CBIC:

By the authority granted by section 9(3) of the CGST Acts, the CBIC has released a list of products and services that are subject to reverse charge.

Provision of goods to a registered dealer by an unregistered dealer

B.Supply from an unregistered dealer to a registered dealer

According to Section 9(4) of the CGST Act, the reverse charge would be applied if a seller who is not registered for GST provides products to an individual who is registered for GST. This implies that the recipient, not the supplier, will be responsible for paying the GST directly. The registered buyer is required to self-invoice for the purchases made and pay the GST under reverse charge.

Reverse charge mechanism (RCM) requires the buyer to pay CGST and SGST on intrastate sales. Additionally, the buyer is responsible for paying the IGST in cases of interstate purchases. The list of products or services that are subject to this provision is periodically updated by the government.

The government issued a notice to the real estate industry stating that the promoter must get 80% of their inward supplies from registered suppliers exclusively. If the purchases from registered dealers fall short by 80%, the promoter is required to impose an 18% GST on the reverse charge, up to the amount that the inward supplies fall short of 80%. On the other hand, the promoter will have to pay a 28% tax if he buys cement from an unregistered source. The 80% computation is not relevant to this calculation; it must be completed.

C.Supply of services through an e-commerce operator

E-commerce operators can be used as aggregators by all kinds of enterprises to sell goods or render services. According to Section 9(5) of the CGST Act, an e-commerce operator shall be subject to the reverse charge and have to pay GST if a service provider utilises him to perform specific services.

WHO SHOULD PAY GST UNDER RCM?

Under RCM, the recipient of goods or services is required to pay GST. Nonetheless, the supplier of the products is required by the GST statute to indicate on the tax invoice whether or not RCM tax is due.

The following considerations need to be made while paying GST under RCM:

- Only if the products or services are utilised for business purposes or to further business endeavours can the beneficiary of the goods or services claim the input tax credit (ITC) on the tax amount paid under the RCM.

- When discharging liability under RCM, a composition dealer should pay tax at the regular rates rather than the composition rates. Furthermore, they are not qualified to receive any input tax credits for taxes paid.

- The tax that is due or paid under the RCM may be subject to the GST compensating cess.

GST Registration and RCM

GST registration plays a crucial role in determining whether RCM applies to a transaction. Businesses that are registered under GST are required to pay tax under RCM only in specific scenarios, such as procuring goods or services from unregistered suppliers or specified registered suppliers.

For businesses, obtaining GST registration is not just a legal requirement but also a strategic decision to navigate the complexities of GST compliance effectively. It ensures eligibility for input tax credit, facilitates seamless interstate transactions, and determines the applicability of provisions like RCM.

CONCLUSION

In conclusion, the Reverse Charge Mechanism (RCM) in GST is a significant shift in tax liability from the supplier to the recipient of goods or services. It is designed to broaden the tax base by ensuring that services imported and transactions with unregistered dealers are also subjected to GST.

Applicability of RCM is governed by specific sections of the Central and State GST Acts, covering scenarios such as supplies of certain goods and services directed by the CBIC, transactions between registered and unregistered dealers, and services provided through e-commerce operators.

Under RCM, the recipient is obligated to pay GST directly, although the supplier must indicate if RCM is applicable on the tax invoice. The input tax credit can be claimed by the recipient if the goods or services are used for business purposes. However, composition dealers are subject to regular tax rates under RCM and cannot claim input tax credits.

Overall, RCM plays a crucial role in ensuring compliance, broadening the tax net, and facilitating smoother taxation in the GST regime. It requires careful attention to compliance and understanding of specific provisions to avoid any potential issues or penalties.