Everything you need to know about GST

What is GST?

India levies a tax known as Goods and Services Tax (GST) on the provision of some goods and services. It was enacted to take the place of several other indirect taxes, such as the excise duty, purchase tax, value-added tax (VAT), and service tax.

Put otherwise, the provision of goods and services is subject to the Goods and Service Tax. Every value addition is subject to the comprehensive, multi-stage, destination-based Goods and Services Tax Law in India. For the whole nation, there is only one domestic indirect tax law or GST.

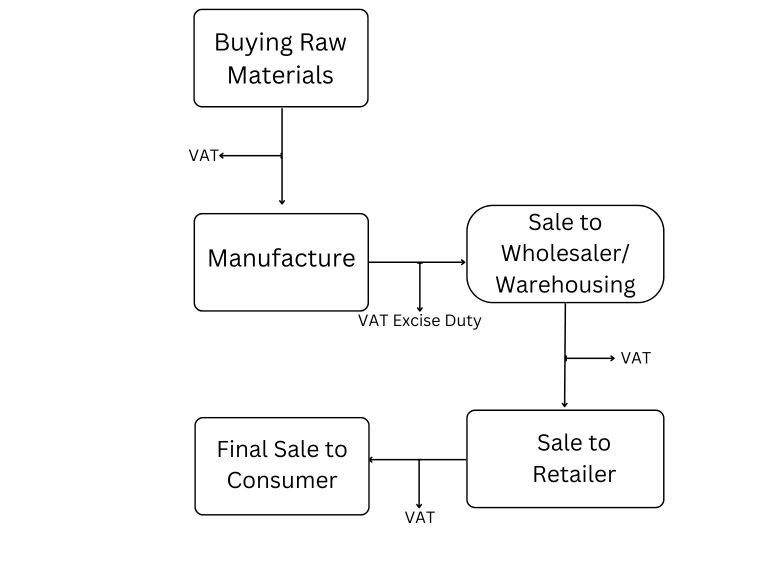

The indirect tax levy structure in India prior to the implementation of the Goods and Services Tax was as follows:

The tax is imposed under the GST framework at each point of sale. Both state and central taxes are applied to sales within the same state. The Integrated GST applies to all interstate sales.

What are the indirect taxes that GST has replace?

Designed as a uniformed tax for the entire nation, it will replace the following indirect taxes earlier levied by the Centre and the State-

Taxes levied and collected by the Centre:

- Central Excise duty

- Additional Duties of Customs (commonly known as CVD)

- Special Additional Duty of Customs (SAD)

- Service Tax

- Taxes levied and collected by the State:

State VAT - Central Sales Tax

- Entertainment and Amusement Tax (except when levied by the local bodies)

- Taxes on lotteries, betting and gambling

What are the types ?

India’s taxation system includes three different forms of Goods and Services Tax. They are

- Central or C GST is levied by the central government.

- S or State GST is levied by the state government.

- I or Integrated GST is levied by the central government on an interstate supply of goods and services.

On the sale of goods or services, either Integrated or both State and Central GST will be charged. If the business is in a union territory, UTGST will replace SGST. The only difference is the name; the concept remains the same.

How to calculate?

Calculating Goods and Services Tax is straightforward. You simply multiply the taxable amount by the GST rate. If both CGST and SGST/UTGST are applicable, each amount is half of the total Goods and service tax.

Formula:

𝐺𝑆𝑇=Taxable Amount×GST Rate

If you already have the total amount including GST and need to find the GST excluding amount, you can use the following formula:

GST Excluding Amount Formula:

GST excluding amount = GST including amount/(1+ GST rate/100)

It’s important to note that the tax is calculated based on the transaction amount, not the Maximum Retail Price (MRP).

Who is liable to pay GST?

Businesses and traders must pay goods and service tax if their yearly sales exceed Rs 20 lakh. In the case of northeastern and special category states, the GST barrier is Rs 10 lakh. Regardless of this threshold, interstate commerce is subject to GST.

Which current taxes are included in this Tax?

It includes state and local taxes like value-added tax (VAT), central sales tax on interstate commerce of goods, luxury tax, entertainment tax (apart from local bodies), taxes on advertisements, taxes on betting and gambling, and state cesses and surcharges on the supply of goods and services. Taxes on production include central excise duty and additional excise duty, import duties include additional customs duty known as countervailing duty and special additional customs duty, service tax, central cesses and surcharges, and GST is included in these categories. It does not include basic customs duty, which includes the import tariff barrier.

Advantages

- It makes the taxes imposed on the provision of goods and services more transparent.

- The average consumer does not currently notice the different embedded tax components when purchasing an item; instead, they only see the state taxes on the product label. Due to the removal of entrance barriers at state borders, the GST will facilitate economic transactions.

- It is anticipated that the new indirect tax system will increase tax compliance, increase central and state government income receipts, and accelerate GDP growth by 1.5–2 percentage points.

- Many items will have less tax burden when cascading taxes are eliminated.

Which goods are excluded ?

For the time being, natural gas, jet fuel, diesel, petrol, and crude oil are not subject to this Tax. When to include these commodities in the GST registration charges will be decided by the GST Council, the federal indirect tax body made up of state finance ministers and presided over by the Union finance minister. Because alcohol is exempt from the tax due to constitutional provisions, adding it to the Tax system would necessitate amending the Constitution.

What is an IGST ?

The integrated goods and services tax is a combined federal and state tax.

What is the process for handling imports?

Imports are subject to IGST since they are regarded as interstate supplies. There is no tax on exports. The business receives a return for taxes paid on the items and services it uses to export, including raw materials.

What is the mechanism that prevents profiteering?

The government included an anti-profiteering provision in the GST law to guard against price increases and ensure that the lower tax burden on goods and services is transferred to customers. In response to complaints alleging profiteering, the soon-to-be-established anti-profiteering authority will take action, ordering a profiteering supplier to reduce prices, returning the buyer’s advantage of a lower tax burden with 18% interest, or recovering the sum in the event that the customer cannot be located or chooses not to file a claim. Additionally, a profit-seeking company may lose its GST registration.

GST Rates

Goods and services are categorized into different tax slabs . These include:

- 0% Tax Rate: Essential goods like food grains, books, etc.

- 5% Tax Rate: Items of mass consumption like packaged food items, footwear, etc.

- 12% and 18% Tax Rate: Standard rate applicable to most goods and services.

- 28% Tax Rate: Luxury items and demerit goods like automobiles, tobacco products, etc.

Registration

Businesses meeting certain criteria are required to register under GST. This includes businesses with an annual turnover exceeding the threshold limit, inter-state suppliers, and those selling through e-commerce platforms. Registration enables businesses to collect tax on behalf of the government, claim input tax credit, and comply with tax regulations.

GST Returns

Registered taxpayers are required to file periodic GST returns to report their sales, purchases, and tax liabilities. The frequency of filing varies based on the type of business and turnover. The GST return filing process has been largely digitized, making compliance easier for taxpayers. Click here to know what happens if it is not filed.

Input Tax Credit (ITC)

One of the significant benefits of GST is the concept of input tax credit. Businesses can claim credit for the tax paid on purchases against the GST liability on sales. This mechanism eliminates the cascading effect of taxes, leading to reduced tax burden and lower prices for consumers.

What is Reverse Charge?

Typically, when the provider supplies items, the tax is levied on the supplier. In some circumstances, the tax is charged against the purchaser of the products. This is known as reverse charge since the chargeability of tax is reversed.

This is not a new feature of GST; the reverse charge existed under the old VAT regime, but only for services. Now, GST will apply to commodities as well.

GST Impact on Businesses:

- Supply Chain Restructuring: Businesses have optimized their supply chains to minimize tax liabilities under GST, leading to operational efficiencies.

- Compliance Challenges: While this tax aims to simplify taxation, compliance can be complex, especially for small businesses. The digital infrastructure for GST compliance is continually evolving to address these challenges.

- Increased Formalization: It has encouraged informal sector players to formalize their operations to avail of input tax credit benefits.

GST and the Economy:

- Boost to GDP: Goods and Services Tax is expected to contribute to India’s GDP growth by streamlining tax administration, reducing tax evasion, and promoting economic activity.

- Inflation Impact: The transition to GST initially led to inflationary pressures due to tax rate changes. However, over time, the inflationary impact has moderated.

- Ease of Doing Business: It has improved India’s ranking in the ease of doing business index by simplifying tax procedures and reducing compliance burdens.

Goods and Services Tax represents a significant milestone in India’s taxation landscape, aimed at creating a unified market and fostering economic growth. While it has brought about fundamental changes, understanding its intricacies is essential for businesses and consumers alike. By staying informed and compliant, stakeholders can harness the benefits of the tax system while navigating its challenges effectively.