Procedure to file ITR

Under a number of circumstances, ITR filing is required by the Income-tax Act, of 1961. Even without the necessary income, there could be several other reasons to file an income tax return, such as carrying over losses, requesting a refund, applying for a VISA, getting a bank loan, getting term insurance, etc.

What is an Income Tax Return (ITR)?

The form used to report information about one’s income and related taxes to the income tax department is called an income tax return. ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 and ITR 7 are the different types. You are not permitted to carry forward some losses when you file a late return.

What is E-Filing?

The act of online filing an income tax return (ITR) over the Internet is known as “e-filing.” A number of features that make the process of filing taxes easier can be accessed by individuals by utilizing their PAN-based login credentials to visit the new income tax portal.

The ability to electronically file an income tax return is offered by the Income Tax Department. Prior to talking about how to electronically file an ITR, a taxpayer must have the following materials/information on hand in order to electronically file their ITR.

Documents required to file ITR

- Bank statements for PAN and Aadhaar

- Form 16 donation receipts

- Stock trading statements from the broker platform

- Payment receipts for life and health insurance policies

- Details about a bank account connected to an Aadhaar-registered cellphone number for E-verification of returns

- Bank interest certificates

Types of ITR?

ITR 1 (Sahaj), ITR 2, ITR 3, ITR 4, ITR 5, ITR 6, and ITR 7 are the 7 different versions of ITRs that are available for different kinds of people, organizations, and companies. One common question that comes up when filing the ITR is which form taxpayers should utilize. For a vast majority of small and medium taxpayers, the more straightforward ITR-1 and ITR-4 forms are appropriate.

The following are the forms’ specifics:

- ITER-1(Sahaj):

The simplest ITR form, ITR-1 (Sahaj), is suitable for residents earning up to ₹50 lakh from the following sources:

- Salary

- One house property

- Additional resources (dividends, interest, family pension, etc.)

- Income from agriculture up to ₹50,000

- ITR-2:

Compared to ITR-1 and ITR-4, ITR-2 is meant for a larger spectrum of taxpayers. The following is a summary of the people who usually utilize ITR-2:

- Hindu Undivided Families (HUFs)

- Individuals who are not qualified to use ITR-1 or ITR-4 This shows that their income comes from a variety of sources, including businesses covered by certain presumptive taxation schemes, housing property, agricultural revenue below a particular threshold, and salaries.

- ITR-3:

Individuals or Hindu Undivided Families who do not qualify to file Form ITR-1 (Sahaj), Form ITR-2, or Form ITR-4 (Sugam) and whose income is classified as “profits or gains of business or profession” may use this form.

- ITR-4 (Sugam):

This form is intended for Hindu Undivided Families and individuals who meet specific income requirements. Revenue from a business or profession with turnovers up to ₹50 lakh or ₹2 crores, respectively, under the presumptive taxation plan (section 44AD or 44ADA). Income from additional sources (pension, interest, dividends, etc.)

- ITR-5:

A wide range of organizations, not just individual taxpayers, use this form. Registered and unregistered businesses, limited liability partnerships (LLPs), cooperative societies, and municipal governments are all considered business entities.

- ITR-6:

Designed exclusively for businesses, this form expedites the filing procedure for these organizations. This is an overview:

- Goal user: Businesses that are officially recognized by the Firms Act of 1956 or the Companies Act of 2013 (including international firms)

Application: Relevant to all corporate configurations (public, private, etc.)

- ITR-7:

If a business wants to claim an exemption under Section 139 (4A) for revenue received from a charitable or religious trust, it must use the ITR-7 Form when filing its income tax return. This includes firms, companies, local authorities, associations of persons (AOP), and Artificial Juridical Persons.

Pre-filing preparation of ITR

Pre-filled Income Tax Returns (ITR) forms were created to utilize technology to facilitate taxpayer compliance with tax laws. In response, the Indian government implemented faceless e-assessment, pre-filing of income tax returns (ITR), and the interchangeability of PAN and Aadhaar.

Online v/s Offline Filing

ONLINE FILING | OFFLINE FILING |

This is the most popular option since it allows you to use the Income Tax Department’s e-filing system to submit your ITR immediately. | Tools for offline use: The department provides downloadable versions of Excel and JSON templates for ITR-1, ITR-2, ITR-4, and even ITR-6 for FY 2023–24 (AY 2024–25) for those who prefer an offline method. With the help of these tools, you can build your ITR offline and then upload it to the e-filing portal for submission. |

Step-by-Step Guide to Online ITR Filing

STEP 1: LOGIN

- Click ‘Login’ after visiting the official Income Tax e-filing website.

- In the User ID field

- Enter your PAN.

- Select “Continue.”

- Examine the security notice by checking the box.

- Enter your password and click “Continue.”

STEP 2: GO TO ‘FILE INCOME TAX RETURN’

Click on the ‘e-File’ tab > ‘Income Tax Returns’ > ‘File Income Tax Return’

STEP 3: SELECT THE RIGHT ‘ASSESSMENT YEAR’

If you are filing for FY 2023–2024, choose ‘Assessment Year’ as ‘AY 2024–25’. Similarly, if you are filing for FY 2022–2023 utilize the mode of filing as “Online” and pick “AY 2023–24.” Make sure you file as an original return or a revised return.

STEP 4: SELECT THE STATUS

- Choose the appropriate filing status for you, such as Individual, HUF, or Others.

- Choose ‘Individual’ and ‘Continue’ to file for people similar to you and me.

STEP 5: SELECT THE ‘ITR TYPE’

Choose the ITR type now. Before filing returns, the taxpayer must first determine which ITR form they need to complete. There are seven ITR forms in all, and Individuals and HUFs can use forms 1 through 4. For instance, individuals and HUFs can use ITR 2 if they have capital gains but no income from a business or profession.

STEP 6: CHOOSE THE REASON TO FILE ITR

You will be asked to indicate why you are filing your returns in the next stage. Decide which of the following best fits your situation:

- There is more taxable income than the basic exemption cap.

- fulfils certain requirements and is needed in order to file an ITR

- Other

STEP 7: VALIDATE THE PRE-FILLED DATA

The majority of the information, including your name, date of birth, Aadhaar, PAN, contact details, and bank details, will already be filled in. Before moving on, thoroughly verify these details. Give the details of your bank account as well. Please make sure these details are pre-validated if you have already submitted them.

Make sure you reveal all pertinent information regarding income, exemptions, and deductions as you move step-by-step. The majority of your data will be pre-filled using information from your bank, job, and other sources. Make sure the material is accurate by carefully reviewing it. Verify the information, sign the summary of your returns, and pay any outstanding taxes.

STEP 8: e-VERIFY ITR

Verifying that your return was made within the allotted thirty days is the final and most important step. It is the same as not filing a return at all if you do not validate it. You can choose to e-verify your return by a variety of channels, including Aadhaar OTP, Net Banking, electronic verification codes (EVCs), or mailing a hard copy of your ITR-V to CPC, Bengaluru.

Deadlines and Penalties for ITR Filing

Sr. No. | Particulars | Due Date |

1 | ITR filing for individuals and entities not liable for tax audit | 31st Jul 2024 |

2 | ITR filing for taxpayers covered under the tax audit (other than transfer pricing cases) | 31st Oct 2024 |

3 | ITR filing for taxpayers covered under transfer pricing | 30th Nov 2024 |

4 | Due date for revised return/belated return of income for FY 2023-24 | 31st Dec 2024 |

The deadline for submitting FY 2023–24 reports is July 31, 2024. You have until December 31, 2024, to file a belated return if you fail to file your ITR by the deadline. Nevertheless, you must pay the late filing penalty.

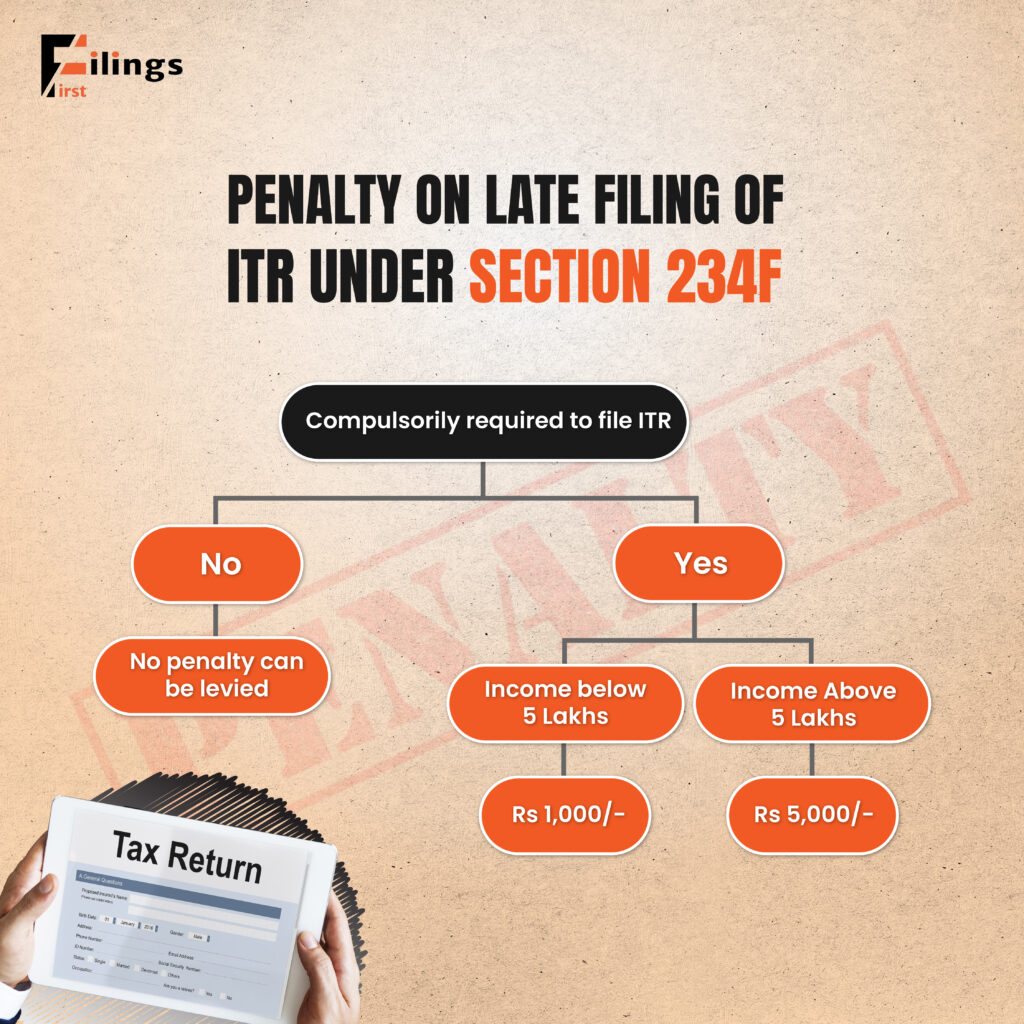

You will be assessed a maximum penalty of Rs 5,000 if you file your ITR after July 31, 2024, but before December 31, 2024.

Small taxpayers, however, are spared; if their total income is less than Rs 5 lakh, the maximum penalty for filing late will be Rs 1,000. There won’t be a penalty if total income stays below the basic exemption threshold.

PENALTY ON LATE FILING OF ITR UNDER SECTION 234F

We hope that you have gotten a brief idea of the process of filing your ITR. if you are looking for someone to help you with the filing of ITR, reach out to us at FilingsFirst.