EPF vs. PPF vs. VPF

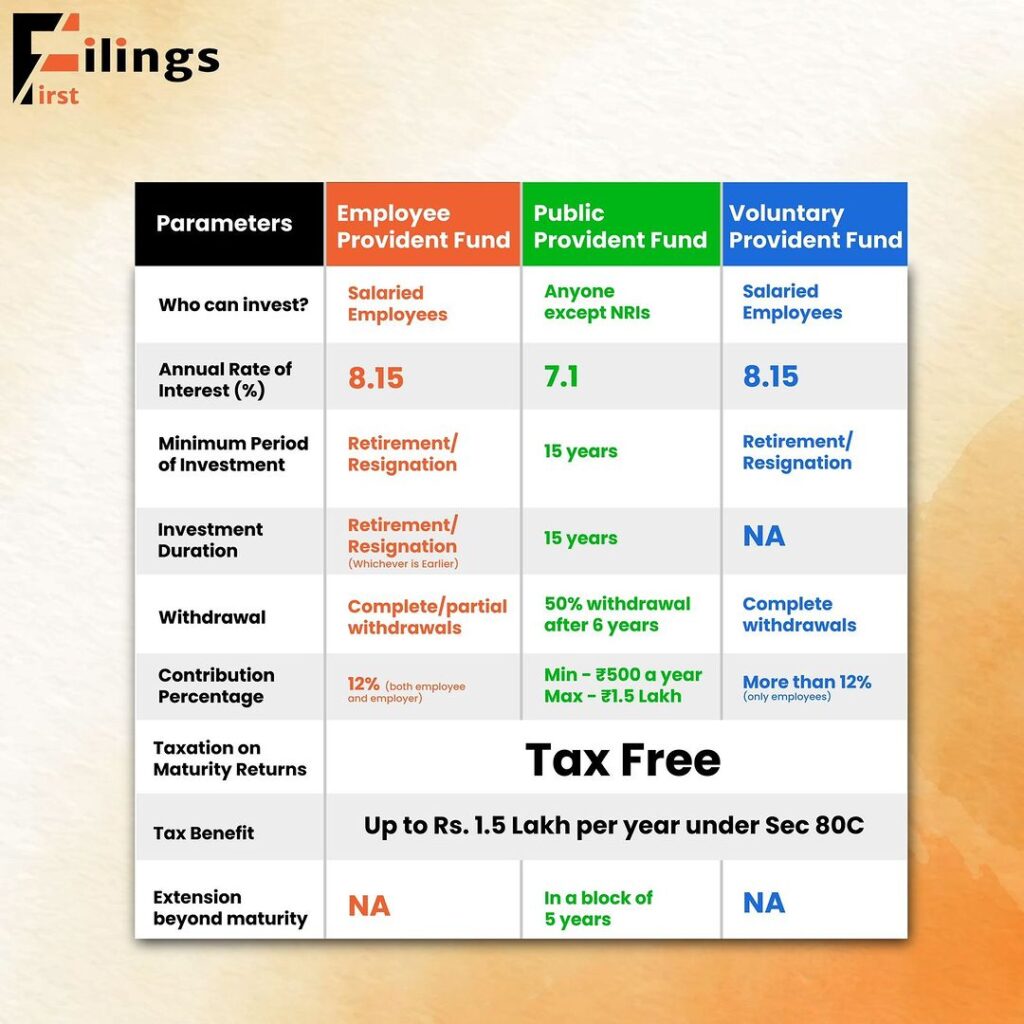

EPF vs PPF vs VPF : In India, there are three major retirement plans for employees: the Employees Provident Fund (EPF), the Public Provident Fund (PPF), and the Voluntary Provident Fund (VPF). All these plans vary in interest rates, withdrawal rules, and taxation.

With the increase in financial literacy and more people working in the private sector, which does not offer retirement planning, more people are starting to save and plan for their retirement.

It can be confusing to choose a retirement plan. In this blog, let’s look into each plan in detail and help you decide which is the best based on your needs.

What is EPF?

EPF, or employee provident fund, is a retirement savings scheme created with the purpose of providing financial security and stability in the future. Under this plan, you contribute a part of your salary every month. The money invested in EPFs grows over time and can be used during retirement or when certain conditions are met.

It is mandatory for private sector organisations to be registered under the Employees Provident Fund Organization and contribute either 12% of their Basic + Dearness Allowance or Rs. 780 towards EPF. In this plan, the employer is also required to contribute 12% of their employees basic salaries. EPF is risk-free and eligible for tax deductions, making it an effective investment tool.

What is VPF?

VPF, or voluntary provident fund, is an additional savings option for salaried individuals in India. Under this, employees can contribute more than the mandatory requirement of 12% towards their provident fund. However, there is no obligation for employers to make any contribution to VPF.

What is PPF?

PPF, or public provident fund, is a government-backed savings scheme, and unlike EPF, it is open to all individuals. Any Indian citizen is eligible to open a PPF account, whether they are a student, self-employed, salaried, or even retired.

It is an attractive investment scheme because the interest earned on PPf is compounded, which means that along with the interest earned on the money you contributed, you also earn interest on interest.

Eligibility criteria for EPF, VPF, and PPF

Employees working in organisations with 20 or more employees are eligible to avail themselves of an EPF account. Employees eligible for EPF are also eligible for VPF, as it is an extension of the same.

On the other hand, any Indian citizen can open a PPF account. A PPF account can be opened at a bank or post office.

Contribution

It is mandatory to contribute 12% of your basic salary for EPFs, while both PPF and VPF contributions are completely voluntary.

There are upper limits on how much can be invested in each scheme. For example, PPF has an upper limit of one lakh per year. However, there are no such limitations on VPF.

Returns

The VPF and EPF interest rates are similar; currently, they are 8.55%. This interest rate is governed by the EPFO (Employees’ Provident Fund Organization), which revises the rate every year.

PPF offers an interest rate of 8%, but this interest rate is linked to 10-year government bond yields and hence may change according to the market. But there is nothing to worry about as government bonds are very safe investments.

Tax benefits

EPF (Employee Provident Fund)

The employee’s contribution is eligible for deduction up to ₹1.5 lakh per year under Section 80C of the Income Tax Act. The interest earned on EPF is tax-free, and the proceeds from EPF are exempt from tax if the employee has served the company for a continuous period of 5 years.

If the individual withdraws the EPF balance before completing 5 years of continuous service, some tax will still be implied.

VPF (Voluntary Provident Fund)

VPF contributions are eligible for a tax deduction of ₹1.5 lakh per year under Section 80C of the Income Tax Act. The other tax implications are the same as for EPF since it is an extension of EPF.

PPF (Public Provident Fund)

Its contributions are also eligible for a tax deduction of ₹1.5 lakh per year under Section 80C of the Income Tax Act.

PPF has a lock-in period of 15 years, and upon maturity, the entire amount, including interest, can be withdrawn tax-free.

Withdrawal Facility

In EPF accounts, employees can take partial withdrawals for specific purposes like education, housing, marriage, etc.

For a complete withdrawal, the entire PPF amount can be withdrawn upon maturity, which is 15 years from the end of the financial year of account opening. However, in the case of a PPF account, it is to be maintained for 15 years and can be withdrawn in partial amounts, subject to certain conditions. The account can be extended for another five years.

VPF does not have a separate withdrawal facility since it is a part of EPF. The withdrawal rules for EPF apply to the VPF amount as well.

Loan Facility

Unlike PPF loans, one can withdraw their entire investment after the onset of the 6th year for VPF vs. EPF loans, while only 50% of the available balance at the end of the 4th year is withdrawable for PPF loans. In other words, the full amount cannot be withdrawn.

Maturity Period

Here are the different maturity periods of EPF vs. PPF vs. VPF:

EPF

EPF typically has a maturity period of 15 years from the date of opening the account. The lock-in period is 5 years, and the accumulated funds, including the principal and interest, can be withdrawn under certain conditions like retirement, resignation, or two months of unemployment.

PPF

The maturity period for PPF is 15 years from the end of the financial year in which the account was opened. The 15-year lock-in period can be extended upon request.

VPF

VPF does not have a separate maturity period since it is an extension of EPF; it follows the same maturity period of 15 years. It also has the same lock-in period as EPF: 5 years.

EPF, VPF, and PPF have their own pros and cons and are excellent instruments for aiding in the retirement planning of individuals. EPF is a good choice for salaried employees, and individuals focusing on saving can invest in VPFs. PPFs are perfect for non-salaried individuals looking for retirement planning.