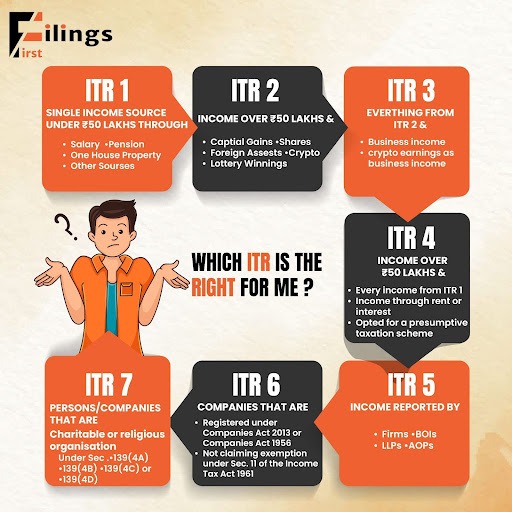

Income Tax Returns - Know about Which ITR You Should File?

Filing Income Tax Returns (ITR) is an essential aspect of financial responsibility for individuals and businesses alike. However, navigating through the various types of ITR forms can be daunting. In this blog, we’ll break down the different types of forms and help you understand which one is most suitable for your specific financial situation.

What is ITR?

Income Tax Return, is the form where taxpayers report their income and tax payments to the income tax department. It must be filed by the due date based on the taxpayer’s category and income type. It’s crucial to calculate tax payable, consider any carry forward losses, and refer to Form 26AS for details on TDS and other income sources. Having Form 16 helps in accurately reporting salary and tax-saving deductions.

Types of ITR

ITR-1 (Sahaj):

For resident individuals with total income up to Rs 50 lakh, encompassing salary, house property, and other sources. Not applicable for NRIs. Salaried individuals can conveniently file using Form 16, directly uploaded on platforms like https://filingsfirst.com/

ITR-2:

Suitable for individuals and HUFs with income from sources other than business or profession, including salary, house property, and capital gains. Salaried individuals with gains or losses from share transactions should opt for ITR-2.

ITR-3:

Intended for individuals reporting income from business or profession, including salaried individuals engaged in intraday trading or futures and options. Covers income from salaries, house property, capital gains, business or profession, and other sources.

ITR-4 (Sugam):

Designed for individuals, HUFs, and partnership firms under the presumptive taxation scheme. Applicable to businesses with turnover up to Rs 2 crore or professionals with turnover up to Rs 50 lakh. Freelancers engaged in specified professions can also use ITR-4.

ITR-5:

Reserved for partnership firms, LLPs, AOPs, and BOIs, enabling them to report income from business, profession, and other sources.

ITR-6:

Mandatory for companies to declare income from business or profession, along with any other sources of income.

How to File?

Filing your Income Tax Return for the Financial Year 2019-20, corresponding to the Assessment Year 2020-21, is primarily done online. This digital filing is mandatory for all taxpayers, except super senior citizens aged 80 years and above.

When filing, you’ll report income from various sources such as salary, house property, business or profession, capital gains, and other sources. Calculate your aggregate income and claim deductions for tax savings and other eligible expenses. Deduct TDS on your income, Tax Collected at Source (TCS), advance tax, and any other tax credits from your tax payable amount.

If you’ve paid excess tax or TDS, you can claim a tax refund. However, if there’s a balance tax payable, ensure you clear it before filing your ITR. Stay vigilant and organized to accurately file your taxes and make the most of available deductions and refunds.

Efiling of income tax that is we can file itr online, contact Filingsfirst for easy process.

Types of Forms for ITR e-filing

Form 16:

Form 16 serves as a crucial document for employees, issued by their employers. It outlines details of gross salary, exemptions like HRA and LTA, net taxable salary, other reported income/loss, tax-saving deductions, and salary TDS.

Form 26AS:

Form 26AS provides a comprehensive record of tax deducted at source (TDS) on various incomes such as salary, interest, and sale of immovable property. It also includes details of self-assessment tax, advance tax payments, and specified financial transactions.

Form 15G and Form 15H:

Form 15G and Form 15H offer a means to receive income without TDS deductions. Form 15G is applicable for individuals below 60 years of age with annual taxable income below the basic exemption limit. Form 15H is for senior citizens with nil tax due on their total income. Submitting these forms to the payer ensures the smooth receipt of income without TDS deductions.

Filing your Tax Returns diligently not only ensures compliance with tax regulations but also enables you to maximize tax benefits and avoid penalties. Stay informed and organized to streamline the tax filing process effectively.

FAQS:

1.Which ITR form should I file if I’m a salaried individual with no other sources of income?

If you’re a salaried individual with no income from business or profession, you should file ITR-1 (Sahaj) for the assessment year. This form is suitable for reporting income from salary, house property, and other sources, provided your total income does not exceed Rs 50 lakh.

2.I have income from capital gains. Which Income Tax return form should I use?

If you have income from capital gains along with other sources, you should file ITR-2. This form is applicable for individuals and HUFs with income from sources other than business or profession, including capital gains.

3.I’m a freelancer with income from business or profession. Which Income Tax Return form should I opt for?

Freelancers and individuals with income from business or profession should file ITR-3. This form allows reporting of income from salaries, house property, capital gains, business or profession, and other sources.

4.What if I have income under the presumptive taxation scheme?

If your income falls under the presumptive taxation scheme, such as turnover up to Rs 2 crore for businesses or Rs 50 lakh for professions, you should file ITR-4 (Sugam). This form is specifically designed for individuals, HUFs, and partnership firms under this scheme.

5.I’m a company. Which ITR form should I use to file my income tax return?

Companies should file their income tax return using ITR-6. This form is meant for reporting income from business or profession, along with any other sources of income, for companies.

ITR-7: Specifically for companies, associations, and trusts seeking income tax exemption.