UNDERSTANDING THE INDIAN TAXATION SYSTEM

India has had a taxation system in place for many centuries. The money gathered from taxable income is used by the government to further national development. In the past, taxes were paid by farmers and traders in the form of produce, gold, and silver. The taxation system was formalised by the government during the period of independence. They introduced Indian citizens to a well-designed tax system with the goal of promoting economic transformation and eliminating wealth inequality.

The government has changed a number of laws over time in an effort to streamline and mechanise the tax process. Let’s dive in to learn more about India’s tax system and structure.

The Taxation System

India’s tax or taxation system can be essentially divided into two categories: direct taxes and indirect taxes. In addition to this, the government introduced the Goods and Services Tax (GST) to the tax structure in 2017. Direct taxes are those that are imposed on private citizens or corporate entities directly.

While both individuals and business entities are subject to direct taxes on their taxable income, it is the assessees’ responsibility to deposit the taxes. Conversely, indirect taxes are imposed on the provision and sale of products and services, respectively, and the sellers bear the responsibility of collecting and depositing the taxes rather than the assessees directly.

India’s tax system is set up such that both the federal government and the state governments are responsible for collecting taxes. The municipality and local governments, among other local agencies, also impose some small levies.

In an effort to increase automation, predictability, and justice, the Central Government and numerous State Governments have implemented a number of policy changes and procedure simplifications in recent years.

India’s climb from 142nd place in 2014 to 63rd place in 2022 in the ‘World Bank’s Ease of Doing Business Rating 2022’ [EoDB] is a direct result of this, as seen by the country’s explosive ascent to the top 100 in the EoDB rating. Reforms like the Goods and Services Tax (GST) have been implemented to simplify India’s intricate system of indirect taxes.

| MAJOR CENTRAL TAXES | MAJOR STATE TAXES |

|---|---|

| Income Tax | State Goods and Services Tax (SGST) |

| Central Goods and Services Tax (CGST) | Stamp Duty and Registration |

| Customs Duty | |

| Integrated Goods and Services Tax (IGST) |

A.TYPES OF TAXES

In India, the two main categories of government taxes are those levied by the Central and State governments:

Taxes:

- Direct

- Indirect

In India, you pay indirect taxes on expenses rather than direct taxes on your earnings. The earning party—a person, a HUF, or a business—is in charge of depositing the direct tax liability.

Corporate entities and companies that offer goods and services are primarily responsible for collecting indirect taxes. Therefore, it is these entities’ responsibility to submit indirect taxes.

What are Direct Taxes?

Both people and corporate entities are subject to direct taxes. You cannot transfer these taxes to another person. Income tax is the most significant kind of direct tax for individual taxpayers like you.

This tax is imposed from April 1 to March 31 of every assessment year. If your yearly income exceeds the minimal exemption limit, you are required by the Income Tax Act of 1961 to pay income tax. The Act offers tax incentives under a number of different parts.

In India, direct taxes make up about half of the government’s income. But there are other direct taxes besides income tax. The following categories of direct taxes are relevant in India:

- Corporate Tax

- Income Tax

- Capital Gains Tax

What are Indirect Taxes?

Indirect taxes are levied on goods and services at the time of purchase or sale. The vendor is the one who pays the taxes to the government, not the individual. Customs duties and security transaction taxes are two instances of taxes that are classified as indirect taxes.

One of the largest indirect tax reforms in the nation is the GST.

GST is a comprehensive indirect tax that is applied nationally to the production, distribution, and use of goods and services. It has taken the place of all indirect taxes that the federal and state governments imposed on goods and services.

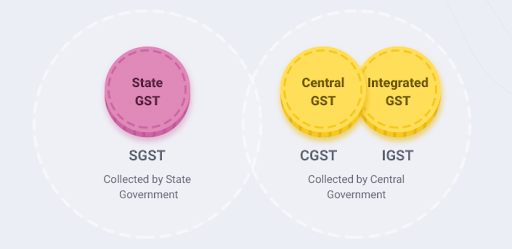

The GST regime went into effect on July 1st, 2017, and India chose the dual GST model, under which taxes are levied by the federal government and the states:

Update on GST Collection: In February 2024, a total of INR 1,68,337 Cr was collected in gross GST income. Of this, INR 31,785 Cr was received as CGST, INR 39,615 Cr as SGST, INR 84,098 Cr as IGST, and INR 12,839 Cr as Cess.

Note: All items save the following are subject to the GST:

- Distilled alcohol for human use

- There are five petroleum products: motor spirit, natural gas, petroleum crude, high-speed diesel and aviation turbine fuel. GST on these will be charged after the effective date is announced.

Benefits of GST:

- Because indirect taxes are unified, there is a reduction in compliance costs.

- Little amount of physical interface

- Examine instances of tax evasion using a strong IT-based administrative

- A single, unified tax system for goods and services

- Not a tax cascade

CONCLUSION

Over the past ten years, India’s tax system, including the income tax structure, has seen major historic revisions. The simplicity of filing taxes online and the simplification of tax legislation have been revolutionary. These modifications have enhanced compliance, decreased tax evasion, and regulated the unorganised sectors.