INPUT TAX CREDIT

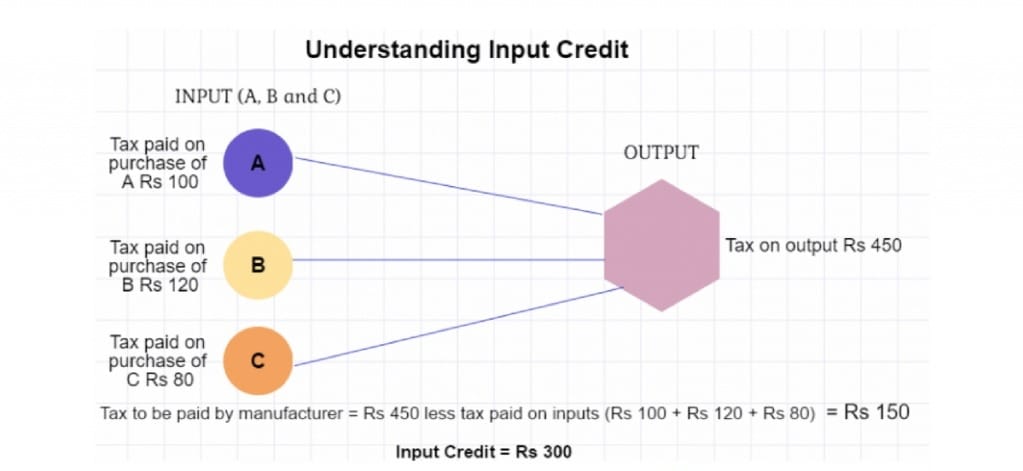

Input Tax Credit (ITC) is a mechanism in the taxation system that allows businesses to offset taxes paid on inputs against taxes they owe on outputs. It ensures that taxes paid at each stage of the supply chain are not double-taxed. Businesses can deduct the tax they pay on purchases from the tax they collect on sales. This system promotes efficiency, prevents tax cascading, and encourages compliance. ITC is a fundamental feature in many value-added tax (VAT) and goods and services tax (GST) systems worldwide, facilitating smoother functioning of the tax regime and reducing the burden on businesses.

WHAT IS ITC?

With an input tax credit, you can pay the remaining amount and deduct the tax you have already paid on inputs when paying output taxes.

Here’s how to do it:

You are responsible for paying taxes on purchases made from registered dealers of goods and services. The tax is collected when you sell. The amount of output tax, or tax on sales, is deducted from the taxes paid at the time of purchase, and the remaining tax liability, or tax on sales less tax on purchase, must be paid to the government. We refer to this method as input tax credit utilization.

CLAIM ITC

WHO CAN CLAIM ITC?

A person registered under GST may only claim ITC if ALL the requirements are met.

- The tax invoice should be with the dealer.

- The specified items or services have been obtained.

- There have been filed returns.

- The provider has already paid the government the tax that was assessed.

- ITC claims for items received in installments are only eligible to be made upon receipt of the final lot.

- If depreciation has been claimed on the tax component of a capital good, no ITC will be permitted.

- ITC claims cannot be made by a person enrolled in the GST composition system.

WHAT CAN BE CLAIMED AS ITC?

ITC is only eligible for claims made for commercial use. ITC won’t be offered for products or services that are only utilized for:

- Individual us

- Exclusivity in supply

- Supplies for which there is a special lack of ITC

HOW TO CLAIM ITC?

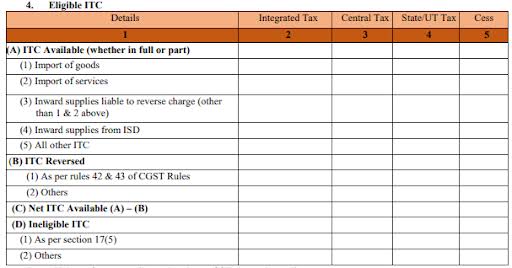

The input tax credit (ITC) amount is required to be reported by all regular taxpayers on Form GSTR-3B, their monthly GST reports. The summary figure of the eligible, ineligible, and reversed ITC for the tax period must be entered in Table 4.

Up to October 9, 2019, a taxpayer was eligible to claim any amount of provisional ITC. Later, the government imposed the following restrictions on the temporary ITC:

Applicable date

% of provisional ITC

- Upto 09.10.2019

- 09.10.2019 to 31.12.2019

- 01.01.2020 to 31.12.2020

- 01.01.2021 to 31.12.2021

- From 01.01.2022 onwards

- No limit

- 20%

- 10%

- 5%

- Nil

DOCUMENTS REQUIRED FOR ITC

The following documents are required for claiming ITC:

- Invoice issued by the supplier of goods/services

- The debit note issued by the supplier to the recipient (if any)

- Bill of entry

- An invoice issued under certain circumstances like the bill of supply issued instead of a tax invoice if the amount is less than Rs 200 or in situations where the reverse charge is applicable as per GST law.

- An invoice or credit note issued by the Input Service Distributor(ISD) as per the invoice rules under GST.

- A bill of supply issued by the supplier of goods and services or bot

In conclusion, Input Tax Credit (ITC) stands as a pivotal component in modern taxation frameworks, fostering economic efficiency, reducing tax cascading, and promoting compliance. By allowing businesses to offset taxes paid on inputs against taxes owed on outputs, ITC streamlines the tax process, ensuring fairness and accuracy.

Its implementation not only benefits businesses by reducing tax burdens and improving cash flow but also contributes to a more transparent and equitable tax system overall. As a cornerstone of value-added tax (VAT) and goods and services tax (GST) regimes worldwide, ITC plays a vital role in driving economic growth and facilitating smooth business operations.