Clubbing of Income Under the Income Tax Act

In India, it’s common to hear suggestions like, “Take payments in your spouse’s name to save tax.” This is because India has a progressive tax system where your tax liability increases with your income. To reduce their tax burden, many individuals transfer their assets or income sources to the names of their spouses, children, parents, or other relatives. To prevent such practices, the Income Tax Act includes provisions for the clubbing of income under sections 60 to 64.

This guide will help you understand the rules regarding the clubbing of income.

What is Clubbing of Income in the Income Tax Act?

Clubbing of income refers to including another person’s income in your taxable income. This generally happens when income is transferred to someone else, such as a spouse or minor child, to lower the overall tax burden. The Income Tax Act contains specific sections (60 to 64) to prevent such tax avoidance strategies and ensure the income is taxed in the hands of the person who actually earns it.

Key Sections on Clubbing of Income

Section | Provision |

Section 60 | Transfer of income without transferring the asset |

Section 61 | Revocable transfer of assets |

Section 64(1)(ii) | Clubbing of income of spouse |

Section 64(1)(iv) | Clubbing of income of spouse |

Section 64(1)(vii) | Clubbing of income of spouse |

Section 64(1)(vi) | Clubbing of income in case of son’s wife |

Section 64(1)(viii) | Clubbing of income in case of son’s wife |

Section 64(1A) | Clubbing of income of minor child |

Section 64(2) | Clubbing of income & Hindu Undivided Family (HUF) |

When Will Provisions of Clubbing of Income Be Applicable?

1. Transfer of Income Without Transfer of Asset (Section 60)

If a person transfers income without transferring the ownership of the asset that generates the income, the income will be taxed in the hands of the transferor.

Example:

Ravi owns a property that earns ₹25,000 per month in rent. To reduce his tax burden, he instructs the tenant to pay the rent to his wife’s account. Since Ravi hasn’t transferred the ownership of the property, the rental income will still be taxed in his hands.

2. Revocable Transfer of Asset (Section 61)

When an asset is transferred with a condition that the transferor can reclaim it in the future, it is considered a revocable transfer. Income from such an asset will be taxed in the hands of the transferor.

Example:

Nisha transfers a commercial property to her friend but retains the right to take it back after five years. Any income earned by her friend from this property will be taxed in Nisha’s hands due to the revocable transfer condition.

3. Clubbing of Income of Spouse (Section 64(1)(ii), 64(1)(iv), 64(1)(vii))

Income transferred to a spouse is governed by specific rules:

- If the spouse works in a business where the transferor has a substantial interest, the income will be taxed in the transferor’s hands unless the spouse’s employment is due to professional or technical qualifications.

- If both spouses receive income from a business where both have a substantial interest, the income is clubbed with the spouse having the higher income, excluding the remuneration.

- If an income-generating asset is transferred to a spouse without adequate consideration, the income from that asset is taxed in the transferor’s hands.

Example:

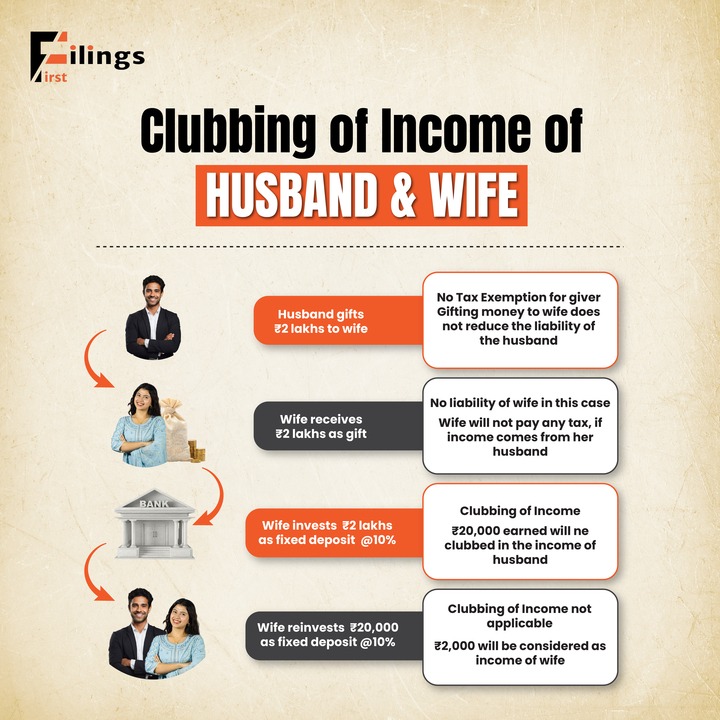

Mr. Gupta gifts ₹8,00,000 to his wife, who then invests it in fixed deposits and earns interest. The interest income will be taxed in Mr. Gupta’s hands as per section 64(1)(iv).

4. Clubbing of Income in Case of Son’s Wife (Section 64(1)(vi), 64(1)(viii))

Income transferred to a daughter-in-law without adequate consideration is subject to clubbing provisions. Any income from such an asset will be taxed in the transferor’s hands.

Example:

You transfer shares worth ₹4,00,000 to your daughter-in-law without consideration. Any dividends from these shares will be taxed in your hands.

5. Clubbing of Income of Minor Child (Section 64(1A))

Any income earned by a minor child is clubbed with the income of the parent whose total income (excluding the minor’s income) is higher. An exemption of ₹1,500 per minor child is provided under section 10(32).

Exceptions:

- Income earned by a minor child with a disability under section 80U.

- Income earned by a minor child through their manual work, skill, talent, or knowledge.

Example:

Anil’s minor daughter earns ₹15,000 from a singing competition. This income will be added to Anil’s income because he earns more than his wife. Anil can claim an exemption of ₹1,500 on this income.

6. Clubbing of Income & HUF (Section 64(2))

If personal assets are transferred to a Hindu Undivided Family (HUF) without adequate consideration, the income from such assets will be taxed in the transferor’s hands. If the HUF is later divided and the assets are distributed, the income from the distributed assets in the spouse’s hands will also be clubbed with the transferor’s income.

Example:

You own a piece of land generating ₹2,50,000 annually, which you transfer to your HUF. Since the transfer was without consideration, the rental income will be taxed in your hands.

Here are the main sections of the Income Tax Act related to clubbing of income and their specified scenarios:

Section | Specified Person | Specified Scenario | Income to be Clubbed |

Section 60 | Any person | Transferring income without transferring the asset by agreement or other means | Any income from such asset will be clubbed in the hands of the transferor |

Section 61 | Any person | Transferring an asset with the condition that it can be revoked | Any income from such asset will be clubbed in the hands of the transferor |

Section 64(1A) | Minor child | Income arising to a minor child, including step-child and adopted child | Income will be clubbed in the hands of the parent with higher income, with a ₹1,500 exemption under old tax regime |

Section 64(1)(ii) | Spouse | Spouse receiving remuneration from a concern where the taxpayer has substantial interest | Income to be clubbed in the hands of the taxpayer or spouse, whichever has higher income, unless spouse has professional qualifications |

Section 64(1)(iv) | Spouse | Direct or indirect transfer of assets to spouse for inadequate consideration | Income from such assets, excluding house property, clubbed in transferor’s hands unless exceptions apply |

Section 64(1)(vi) | Daughter-in-law | Transfer of assets to daughter-in-law for inadequate consideration | Income from such assets is clubbed in the hands of the transferor |

Section 64(1)(vii) | Any person or AOP | Transfer of assets to benefit daughter-in-law either immediately or on deferred basis | Income from such assets considered as transferor’s income and clubbed in their hands |

Section 64(1)(viii) | Any person or AOP | Transfer of assets to benefit spouse either immediately or on deferred basis | Income from such assets considered as transferor’s income and clubbed in their hands |

Section 64(2) | Hindu Undivided Family | Transfer of individual property to HUF for inadequate consideration or conversion to HUF property | Income from such property clubbed in individual’s hands |

Exceptions to Clubbing of Income

- Disabled Child: Income of a disabled minor child specified under section 80U is not clubbed.

- Income from Manual Work: Income earned by a minor child from manual work, or through the application of their skill, talent, or specialized knowledge, is exempt.

- Major Child: Income earned by a major child is not subject to clubbing provisions, including investments made from gifted money, which is exempt from gift tax for relatives.

How to Avoid Clubbing of Income?

Clubbing of income under the Income Tax Act can be managed effectively through various strategies. Here are some tips to minimize tax liability:

Strategy | Description |

Gift Money Before Marriage | Transfer assets or money to your wife or daughter-in-law before marriage to utilize their lower tax brackets. No clubbing provisions apply in such cases, allowing tax savings up to Rs. 2,50,000 annually. |

Pay Rent to Parents | If your parents own a house, pay them rent and claim House Rent Allowance (HRA) exemption. Ensure they fall within the basic exemption limit to minimize their tax liability. |

Health Insurance Deduction | Avail deductions under Section 80D by purchasing health insurance for family members. Up to Rs. 25,000 can be claimed for self, spouse, and children, or Rs. 50,000 if parents are senior citizens. |

Prefer Loan Over Gift | Provide loans to spouse at lower interest rates. Ensure proper documentation and repayment through traceable means to shift tax liability to spouse without clubbing provisions. |

Invest Through Joint Accounts | Invest jointly with family members, where the primary holder has lower tax liability. Income from investments is taxed in their hands, and withdrawals are treated as tax-free gifts, thereby reducing overall tax burden. |

Invest in Spouse’s Name | Invest in income-generating assets under your spouse’s name. Initial income may be clubbed, but subsequent earnings on reinvested income are not taxable in your hands. |

Utilize Tax-Free Investments | Invest in tax-saving instruments like PPF and equity products under family members’ names to earn tax-free returns. Ensure compliance with applicable tax rules. |

How to File ITR in Case of Clubbing of Income?

When filing Income Tax Returns (ITR) involving clubbed income, follow these guidelines:

Nature of Clubbed Income | ITR Form to Use | Explanation |

Interest Income, Winnings, etc. | ITR-2 | Include clubbed income under “Income From Other Sources.” |

Rental Income from Property | ITR-2 or ITR-1 (if no other income) | Report clubbed rental income under “Income From House Property.” |

Other Sources of Income | Appropriate ITR Form | Based on the source of clubbed income, choose the corresponding ITR form. Ensure accurate disclosure to avoid penalties and scrutiny. |

Example Scenario:

Mr. Raj has a total income of Rs. 8,00,000 from salary. His minor daughter, Miss Riya, earned Rs. 1,50,000 from interest on investments. According to clubbing provisions, this income is added to Mr. Raj’s income.

- ITR Form: Mr. Raj needs to file ITR-2 due to clubbing of interest income.

- Explanation: If Riya had no income, ITR-1 would have sufficed for Mr. Raj’s filing.

Understanding these nuances helps in accurate income tax filing and ensures compliance with the Income Tax Act.