COMMON DEDUCTIONS YOU MIGHT BE MISSING ON YOUR TAX RETURN It is recommended that you begin the process of filing income tax returns (ITRs) for the current assessment year...

UNDERSTANDING INCOME TAX: A BEGINNER’S GUIDE For every person, paying their first income tax is a significant occasion. For a novice, though, the procedure may appear overly complicated and...

TDS THRESHOLD LIMIT The Tax Deducted at Source (TDS) section of the Indian Income Tax Act mandates certain entities to deduct tax at the point of income generation. This...

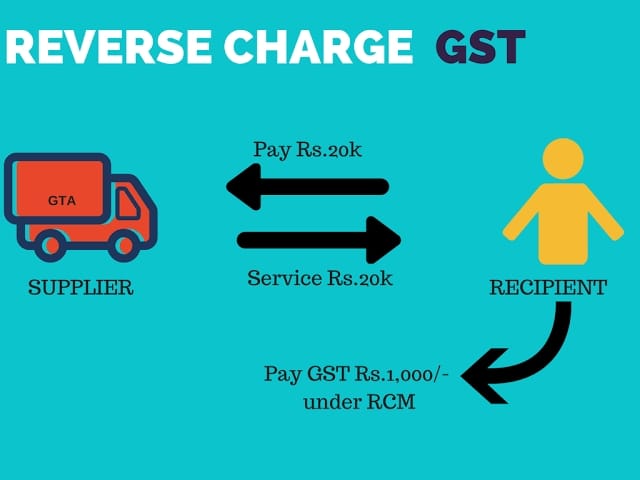

REVERSE CHARGE MECHANISM IN GST A technique known as “reverse charge mechanism” places the burden of Goods and Services Tax (GST) on the recipient of the goods or services...

INPUT TAX CREDIT Input Tax Credit (ITC) is a mechanism in the taxation system that allows businesses to offset taxes paid on inputs against taxes they owe on outputs....