UNDERSTANDING INCOME TAX: A BEGINNER’S GUIDE For every person, paying their first income tax is a significant occasion. For a novice, though, the procedure may appear overly complicated and...

COPYRIGHT In the vast landscape of creative expression, copyright stand as the guardians of innovation and originality. They form the bedrock of legal protection, ensuring that the fruits of creativity are...

PARTNERSHIP FIRM A formal agreement between two or more people to run a business together and split the profits is called a partnership. There are various kinds of agreements...

TDS THRESHOLD LIMIT The Tax Deducted at Source (TDS) section of the Indian Income Tax Act mandates certain entities to deduct tax at the point of income generation. This...

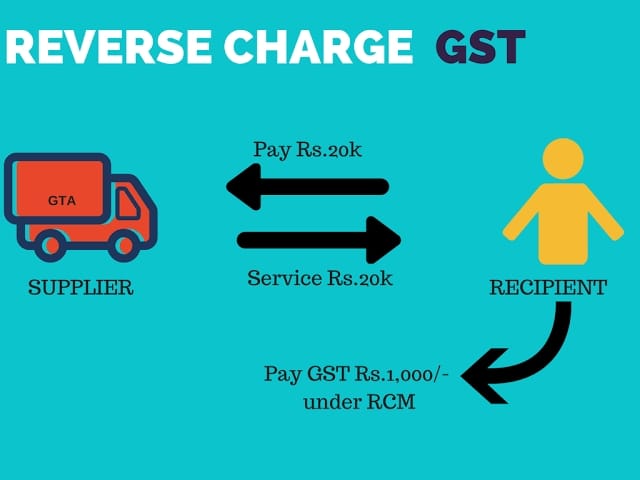

REVERSE CHARGE MECHANISM IN GST A technique known as “reverse charge mechanism” places the burden of Goods and Services Tax (GST) on the recipient of the goods or services...

TAX DEDUCTED AT SOURCE Tax Deducted at Source is a fundamental aspect of the Indian taxation system, yet it often baffles even seasoned taxpayers. Understanding Tax deducted at source...

INPUT TAX CREDIT Input Tax Credit (ITC) is a mechanism in the taxation system that allows businesses to offset taxes paid on inputs against taxes they owe on outputs....

Professional Tax If you are a working professional, then you would have definitely heard about professional taxes. The term “professional tax” has probably appeared on your pay stubs each...

Employee’s State Insurance Corporation Welcome to our comprehensive blog dedicated to the Employee’s State Insurance Corporation (ESIC). Established in 1952 under the provisions of the Employees’ State Insurance Act,...

PROTECT YOUR ONLINE BUSINESS WITH TRADEMARK REGISTRATION In India, registering your tm is a crucial step in protecting your brand. With a registered trademark, you have the exclusive right...