INCOME TAX SLABS FY 2023-24 AND AY 2024-25 (NEW & OLD REGIME TAX RATES)

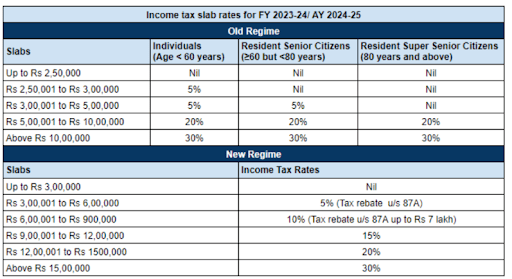

The previous and new tax systems have various income tax slabs. Additionally, there are three categories for the slab rates under the previous tax system.

- Indian citizens under 60 years old.

- All non-residents between 60 and 80 years old: Senior Citizen Residents.

- Over 80 years old: Super senior citizens who live there.

WHAT IS AN INCOME TAX SLAB?

Individuals in India are subject to income taxation via a slab system, in which varying tax rates are attributed to varying income brackets. The tax rates rise in tandem with an individual’s income.

This kind of taxation makes it possible for the nation to have a progressive and equitable tax structure. Periodically, usually during each budget, the IT slabs are changed. The different taxpayer groups are subject to varied slab rates.

Let’s examine each slab rate that will be in effect for FY 2023–24 (AY 2024–25).

If the total income is less than Rs 5,00,000, there is a tax rebate of up to Rs 12,500 under the Old Regime (not applicable for NRIs)

Observation:

The maximum amount of income tax exemption that applies to individuals, HUFs under 60, and NRIs is Rs 2,50,000.

seniors who are 60 years of age or older but under 80 years of age, up to Rs 3,00,000.

up to Rs 5,00,000 for really elderly individuals who are older than 80.

There will be a surcharge and cess in addition to the tax rates.

However, if total income does not exceed Rs 7,00,000, a rebate of up to Rs. 25,000 is applicable under the new tax regime. (Not relevant to NRIs)

* When total income surpasses Rs 7,00,000, the tax due is equal to the tax rebate. (not applicable to NRIs)

NOTE:

For individuals and HUF choosing the new system, the income tax exemption limit is up to Rs 3,00,000.

In addition to the tax rates, there will be a surcharge and cess.

Comparison of the Income Tax Slabs rates under the previous and current tax regimes

| Old Tax Regime (FY 2022-23 and FY 2023-24) | New Tax Regime | ||||

|---|---|---|---|---|---|

| Income Slabs | Age < 60 years & NRIs | Age of 60 Years to 80 years | Age above 80 Years | FY 2022-23 | FY 2023-24 |

| Up to ₹2,50,000 | NIL | NIL | NIL | NIL | NIL |

| ₹2,50,001 - ₹3,00,000 | 5% | NIL | NIL | 5% | NIL |

| ₹3,00,001 - ₹5,00,000 | 5% | 5% | NIL | 5% | 5% |

| ₹5,00,001 - ₹6,00,000 | 20% | 20% | 20% | 10% | 5% |

| ₹6,00,001 - ₹7,50,000 | 20% | 20% | 20% | 10% | 10% |

| ₹7,50,001 - ₹9,00,000 | 20% | 20% | 20% | 15% | 10% |

| ₹9,00,001 - ₹10,00,000 | 20% | 20% | 20% | 15% | 15% |

| ₹10,00,001 - ₹12,00,000 | 30% | 30% | 30% | 20% | 15% |

| ₹12,00,001 - ₹12,50,000 | 30% | 30% | 30% | 20% | 20% |

| ₹12,50,001 - ₹15,00,000 | 30% | 30% | 30% | 25% | 20% |

| ₹15,00,000 and above | 30% | 30% | 30% | 30% | 30% |

Updated Income Tax Slabs Rate for the New Regime for AY 2024–25 (FY 2023–24)

| Income Slabs | Income Tax Rates FY 2023-24 (AY 2024-25) |

|---|---|

| Up to Rs 3,00,000 | Nil |

| Rs 3,00,000 to Rs 6,00,000 | 5% on income which exceeds Rs 3,00,000 |

| Rs 6,00,000 to Rs 900,000 | Rs. 15,000 + 10% on income more than Rs 6,00,000a |

| Rs 9,00,000 to Rs 12,00,000 | Rs. 45,000 + 15% on income more than Rs 9,00,000 |

| Rs 12,00,000 to Rs 1500,000 | Rs. 90,000 + 20% on income more than Rs 12,00,000 |

| Above Rs 15,00,000 | Rs. 150,000 + 30% on income more than Rs 15,00,000 |

What are the main changes to the ITR filing process from FY 2022–2023 to FY 2023–2024?

- Form 10-IE had to be submitted to switch from the Old tax regime, which was the default for FY 2022–2023, to the New tax regime. You must file under the old regime only after the deadline.

- The default tax regime was changed to the new tax regime for FY 2023–2024; if you wish to submit a return under the previous tax regime with all of the deductions, exemptions, and losses claimed, you must file before the deadline. You are required to file under the new regime beyond the deadline, forfeiting any losses, and giving up the majority of your deductions and exemptions.

Consequences of missing the AY 2024–2025 return filing deadline

The taxpayer will have to choose concessional rates in the New Tax regime but will also have to give up some of the exemptions and deductions available in the current Old Tax system if the return is not filed by the deadline for FY 2023–2024.

There are a total of 70 exclusions and deductions that are prohibited; the most often utilised ones are stated below:

| Particulars | Old Tax Regime | New Tax regime (until 31st March 2023) | New Tax Regime (From 1st April 2023) |

|---|---|---|---|

| Income level for rebate eligibility | ₹ 5 lakhs | ₹ 5 lakhs | ₹ 7 lakhs |

| Standard Deduction | ₹ 50,000 | - | ₹ 50,000 |

| Effective Tax-Free Salary income | ₹ 5.5 lakhs | ₹ 5 lakhs | ₹ 7.5 lakhs |

| Rebate u/s 87A | 12,500 | 12,500 | 25,000 |

| HRA Exemption | ✓ | X | X |

| Leave Travel Allowance (LTA) | ✓ | X | X |

| Other allowances including food allowance of Rs 50/meal subject to 2 meals a day | ✓ | X | X |

| Standard Deduction (Rs 50,000) | ✓ | X | ✓ |

| Entertainment Allowance Deduction and Professional Tax | ✓ | X | X |

| Perquisites for official purposes | ✓ | ✓ | ✓ |

| Interest on Home Loan u/s 24b on self-occupied or vacant property | ✓ | ✓ | X |

| Interest on Home Loan u/s 24b on let-out property | ✓ | ✓ | ✓ |

| Deduction u/s 80C (EPF|LIC|ELSS|PPF|FD|Children’s tuition fee etc) | ✓ | X | X |

| Employee’s (own) contribution to NPS | ✓ | X | X |

| Employer’s contribution to NPS | ✓ | ✓ | ✓ |

| Medical insurance premium – 80D | ✓ | X | X |

| Disabled Individual – 80U | ✓ | X | X |

| Interest on education loan – 80E | ✓ | X | X |

| Interest on Electric vehicle loan – 80EEB | ✓ | X | X |

| Donation to Political party/trust etc – 80G | ✓ | X | X |

| Savings Bank Interest u/s 80TTA and 80TTB | ✓ | X | X |

| Other Chapter VI-A deductions | ✓ | X | X |

| All contributions to Agniveer Corpus Fund – 80CCH | ✓ | Did not exist | ✓ |

| Deduction on Family Pension Income | ✓ | X | ✓ |

| Gifts up to Rs 50,000 | ✓ | ✓ | ✓ |

| Exemption on voluntary retirement 10(10C) | ✓ | ✓ | ✓ |

| Exemption on gratuity u/s 10(10) | ✓ | ✓ | ✓ |

| Exemption on Leave encashment u/s 10(10AA) | ✓ | ✓ | ✓ |

| Exemption on Leave encashment u/s 10(10AA) | ✓ | ✓ | ✓ |

| Daily Allowance | ✓ | ✓ | ✓ |

| Transport Allowance for a specially-abled person | ✓ | ✓ | ✓ |

| Conveyance Allowance | ✓ | ✓ | ✓ |